I have seen many queries related to TDS & TCS in multiple eCommerce seller forums and I’m sure this still confusing for many of us. So, let me try to explain the knowledge that I’ve gained over the last few years by interacting with other sellers in multiple forums, interacting with professionals, and researching online.

In this article, I will try to explain these compliances at a high level and will try to cover each type of compliance in a detailed article later on. Please feel free to comment if I’m wrong somewhere so that I can fine-tune the article.

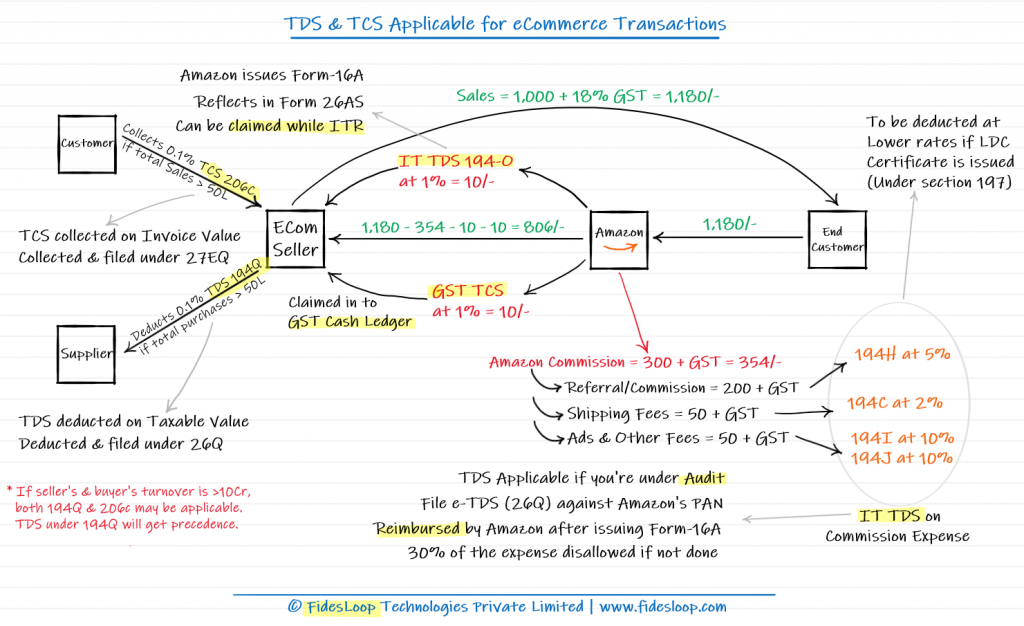

The below flow diagram explains it at a high level. As you can see, TCS and TDS under GST and Income Tax are applicable for eCommerce transactions in different scenarios.

Please continue reading if the below diagram is adding more confusion to it. I’m sure it does! As you can see, it may not be straightforward & and let me try to make it easier for you to understand.

#1) TDS under Section 194H/194C/194I/194J of Income Tax Act

This is applicable if your business is under Audit. You must deduct TDS & pay it to the Govt. on behalf of the Service Providers for all services that you take to be compliant as per Income Tax.

We need to treat Amazon, Flipkart, etc. as e-Commerce Marketplace Service Providers. We need to deduct TDS from their commission invoices under different heads (194H, 194C, 194I-b & 194J) depending on the type of Fees in their monthly invoices. Usually, we get invoices for the commission, shipping fees, warehouse charges, marketplace ads, special services like deals/prime, etc and TDS is applicable on all these invoices. In many cases, there’s a possibility of multiple TDS rates applicable on the same invoice depending on the fee line item type.

There are thresholds for each head and need to deduct TDS if it crosses the threshold limit set for each section. You may research more on this to know the threshold limits for each TDS section in detail. At a high level, the below sections are applicable for the invoices & the rate applicable for each section is given below.

| Section | Normal TDS Rate | TDS Rate (Per Amazon LDC) * | TDS Rate (Per Flipkart LDC) * |

| 194H | 5% | 1% | 0.02% |

| 194C | 2% | 0.1% | 0.01% |

| 194I (b) | 10% | 2% | – |

| 194J Technical | 2% | – | – |

| 194J Professional | 10% | – | – |

* Please refer to the Lower Deduction Certificates for the final LDC rates applicable for your company. The above-mentioned rates are for FY2021-22

What if Lower Deduction Certificate is issued u/s 197?

Flipkart, Amazon, Myntra etc often get Lower TDS Deductions approvals for selected sellers based on their PAN. Hence, we must deduct & pay TDS according to the lower TDS rates approved for the section according to the LDC certificates. You may download the certificates from the Traces website (under Downloads > Certificate 197). Please be watchful for the approved limits for the lower deduction, when you do so. The TDS deduction rate will be according to the normal rates once you cross the threshold limits for lower deduction as per the LDC certificate issued. You will need to mention the LDC certificate number while filing the e-TDS return (26Q) to avoid Short Deduction notices.

When to file this? What is the process?

We need to pay TDS challans every month on or before the 7th for the previous month. We also need to file e-TDS under 26Q every quarter to credit the TDS deducted on behalf of marketplaces against their PAN number. Once you file e-TDS, it will reflect in their Form-26AS. Once the filing is successful, you can generate Form-16A from the Traces portal and you can claim the TDS amount back from marketplaces, once you issue them a copy of Digitally Signed Form-16A.

(2) TCS under GST for our eCommerce Sales (From Oct 2018)

This is applicable from 1 Oct 2018 where marketplaces will deduct 1% TCS on the taxable value of our sales through marketplaces and they will deposit the same when they file their GSTR-8 return on 10th every month.

We will be able to see these TCS credits under TDS Dashboard in the GST portal and we can file TCS return to claim the same into our cash ledger and the same can be utilized to offset our GST output liability.

This is a separate topic for a detailed discussion and you may read more about this in detail HERE

(3) TDS under Section 194O of Income Tax Act for our eCommerce Sales (From Oct 2020)

This is a new section introduced by the Income Tax department for eCommerce Sales. As per this, marketplaces should deduct TDS @1% at the time of credit of the amount of sale of goods/services/both to the account of an e-commerce seller or at the time of making payment to an e-Commerce seller by any other mode, whichever is earlier.

Marketplaces will deduct TDS for every order and deposit the same against our PAN number every quarter. This means, you will see 1% TCS under GST and 1% TDS under IT for every order and you will also see a reversal of these deductions against each order return if you refer to the respective marketplace MTR/GST/Sales Reports.

How can we claim this back?

As you can see in the diagram, marketplaces will deposit the TDS deducted against our PAN numbers when they file the quarterly e-TDS returns. Once they file their quarterly return, we will start seeing the same in our Form-26AS. We can claim this back or consume this to pay our Tax Liability when we file our annual Income Tax Return. Since 1% of the TDS is already deducted and credited against your PAN, you must consider this while computing Advance Tax liability every quarter.

(4) TCS under Section 206C (1H) of the Income Tax Act (From Oct 2020)

TCS to be collected by the seller of Goods at the rate of 0.1% of the sale consideration exceeding Rs 50 lakh per year per customer. This section is applicable when your Turnover for the previous year is in excess of Rs. 10 Crores. This is mostly applicable if we do a lot of Offline B2B and it may be applicable if you supply to Cloudtail, Appario, etc if the total sales value exceeds 50L per year.

Your customer will be able to claim it back at the time of filing their Income Tax Returns.

(5) TDS under Section 194Q of the Income Tax Act (From Jul 2021)

TDS to be collected by the buyer of Goods at the rate of 0.1% on the Taxable Value of the supply if the total purchases Rs 50 lakh per year per customer. Like TCS u/s 206C (1H), this section is also applicable when your Turnover for the previous year is in excess of 10 Crores. This is mostly applicable if we do a lot of Offline B2B and it may be applicable if you supply to Cloudtail, Appario, etc if the total sales value exceeds 50L per year.

Your supplier will be able to claim it back at the time of filing their Income Tax Returns.

What if both 194Q and Sec 206C (1H) for a single transaction?

Well, this is very much possible if the Sales turnover of both the parties is in excess of Rs. 10 Crores for the previous year and if the total value of the transaction exceeds 50 Lakhs per year between them.

If the Supplier sells more than 50L to a Customer, he is liable to collect TCS u/s 206C (1H) for that transaction. At the same time, if the customer buys more than 50L from a Supplier, he is liable to collect TDS under 194Q for that transaction. In these cases where both TCS u/s 206C (1H) and TDS u/s 194Q are applicable, TDS u/s 194Q will take precedence. Please make sure you communicate this with your Supplier to avoid TCS and TDS from different parties for the same transaction.

The Conclusion

I just hope that I did not confuse you further. You may share this with your Consultant/CA/Auditor for further clarification and for detailed information on this. I hope, this helps to get a basic understanding of these compliances and also to clarify some of your queries on this topic. As mentioned earlier we will try to cover each of these in detail in our future articles. Please Subscribe to our Newsletter & share this article if you think it helps the larger e-Commerce Seller Community.

We’re specialists in eCommerce GST & TDS Compliance & we can handle it all for you

We are specialized in e-Commerce GST and TDS compliances since the inception of GST (almost 4 years now). Currently, we are limiting our services to pure e-Commerce Seller or sellers who sell on e-Commerce along with offline. We’ve built enough automation and we’ve tailor-made processes in place to handle GST and other compliances. In a nutshell, we’re well equipped to handle all of these compliance headaches on your behalf.

- We provide services for over 100+ e-Commerce entities from 16 states.

- 100% of our clients are selling on e-Commerce.

- We’ve filed more than 9,000+ e-Commerce GST returns (as of Dec 2021).

- Over 80% of our processes are automated through our in-house system for e-Commerce GST, including the direct integration with GST Poral for uploading data and filing returns, directly from our internal system.

- We take care of everything related to e-Commerce GST compliance, right from sales reconciliation using raw marketplace reports. This helps to limit your involvement to providing raw marketplace reports and offline data, which wont be more than 10-15 minutes a month.

- We do all possible validations & reconciliations (like TCS vs marketplace Turnover Reconciliation, GSTR-2B & 2A reconciliation for ITC, etc.) before we finalize the returns every month, and we do it every month without fail.

- Since our processes are automated, we can do a 100% ITC reconciliation every month to make sure we claim ITC from every eligible invoices without fail.

- Since we spend very less effort on data entry tasks and focus more on validation/reconciliation, we can assure you highest level of accuracy for the compliance filings.

- We also provide TDS Calculation & e-TDS filing as an add-on service to our GST services.

Please reach out to us at compliance@fidesloop.com or on 959 144 3993 (WhatsApp) if you wish to sign up for our Managed Service offering for e-Commerce GST compliance and other add-on services like TDS, e-Commerce Accounting, etc. Alternatively, you click on the Get Quote button in the top-right corner of the website and fill in the details and we will revert you for further discussions.