As we all know, TCS (Tax Collected at Source) under Section-52 of CGST Act, 2017 came into force starting from 01 Oct 2018. Since this is the first month of Filing GST Returns after implementation of Tax Collected at Source, I’m getting lots of queries on (?) how to claim it (?) how to utilize the TCS Credits (?) who should file returns etc. Let me try to explain the detailed procedure for claiming the TCS Credits with my limited knowledge on this so far. Since TDS Credits with respect to eCommerce Marketplace sales is not relevant, I will skip it from the context of this article.

If you’re new to this, I would recommend you to read the article, All About E-Commerce & TCS Compliance under GST Regime before proceeding further.

TCS Returns from the perspective of eCommerce Marketplaces

As per the CGST Act, eCommerce Marketplaces should collect 1% on IGST or 0.5% on CGST plus 0.5% SGST as TCS depending on whether the transaction is Inter-state or Intra-state. It should be collected on the NET Taxable Value of the sales happen through their platform.

And, they should file GSTR-8 in all states from which they have registered sellers & deposit the amount collected under each merchant’s GSTIN Number. They should file GSTR-8 returns on or before the 10th of the next month.

How to claim the TCS Credits filed by eCommerce Marketplace?

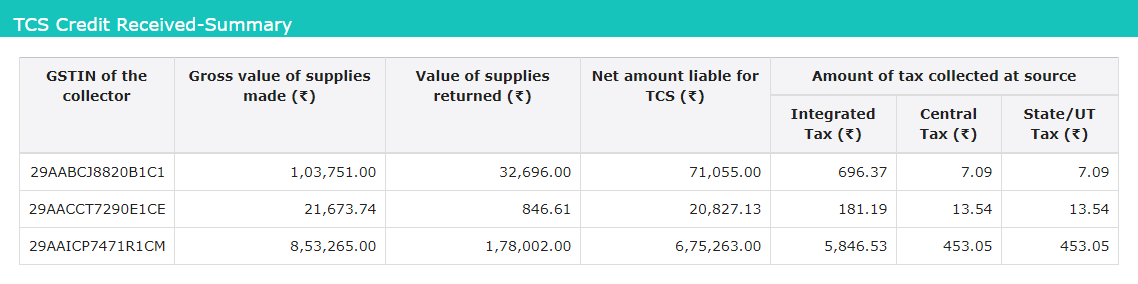

Marketplaces would be reporting Gross Sales & Returns, NET Taxable Value along with the TCS collected against IGST, CGST & SGST every month. Once the marketplaces file their GSTR-8, it will be displayed in GSTR-2A of Sellers GSTIN login under Part-C > TCS Credits section for each month. A sample is given below.

TCS Credits Section” width=”1138″ height=”284″>

TCS Credits Section” width=”1138″ height=”284″>

#1: GSTR-2A Part-C > TCS Credits Section

As per the theory, these TCS Credits should finally flow into Electronic Cash Ledger for us to avail the same. Well, it won’t flow into Electronic Cash Ledger when marketplaces file their GSTR-8, automatically. There are a few things an Individual eCommerce Merchant should do to avail these Credits. Let me explain the process in detail.

Step 1: Validate the Sales Figures posted by Marketplaces under GSTR-8 for TCS

The NET Taxable value would be calculated as the Total of Taxable value for the sale happened during the current month minus (-) the Total of Taxable value for the returns received during the month. Returns received in a particulate month can be for the sale happened during the same month itself or for a sale happened during one of the previous months.

Which means, the NET Taxable Sales value reported by Marketplaces under GSTR-8 would always be greater than the NET Sales figures posted by us when we file GSTR-1, at least for the month of Oct 2018 and for a couple of months thereafter.

This is because we adjust the NET value of the Returns we received for a Sale prior to TCS against the Sales Value in the current month after TCS. When we consolidate the NET Sales for a specific month, we would always consider NET sales happened during the current month & the NET returns received in the current month. Which means, we can very well receive a return for a sale happened prior to 01 Oct 2018 as well.

Let’s define the details as below.

(1) NET Taxable Value of Sales for the Current Month

(2) NET Taxable Value of Returns received for orders after 01 Oct 2018

(3) NET Taxable Value of Returns received for orders before 01 Oct 2018

NET of Turnover as per GSTR-1 = (1) – (2) – (3)

NET of Turnover posted by Marketplaces = (1) – (2)

This means that we will always see an inflated Taxable value for Sales posted in TCS Returns by marketplaces, at least for the initial few months until (3) becomes Zero.

Hence, to validate the TCS Turnover with the value from Marketplace reports, we should always filter out all Orders invoiced before 01 Oct 2018.

Step 2: Accept/Reject the TCS Credits posted by the eCommerce Marketplaces

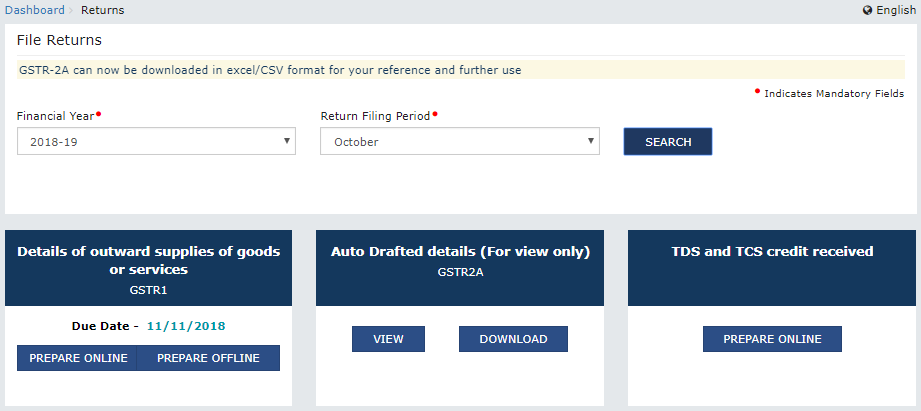

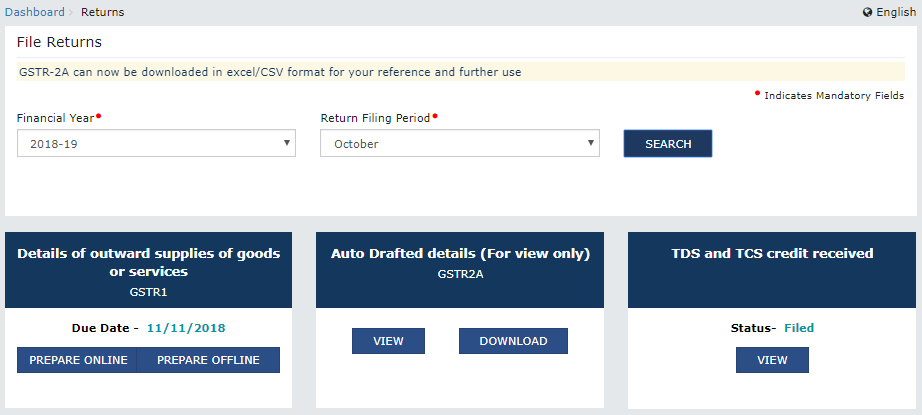

Once you’ve validated the numbers posted by Marketplaces, we need to Accept/Reject it depending on the validation result. Please login to GST Portal & navigate to Return Dashboard for the month you wanted to claim TCS Credits. Return dashboard would look like in the Image #2. Please click on the “Prepare Online” under “TDS and TCS Credits received” section.

#2: Return Dashboard before accepting & filing “TDS and TCS Credits received”

Once you click on the Prepare Online button, you will be seeing a summary of all credits received like the one shown in Image #3. Initially, you will see 0 against every section.

#3: TDS and TCS Credits received – Summary

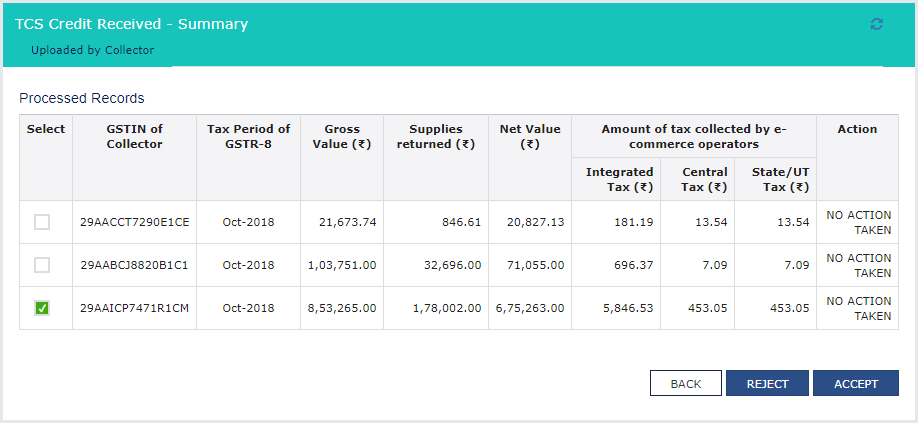

Since we’re interested only in TCS for time being, click on “TCS Credit Received” section & you should see a section similar to what you’ve seen in TCS Credits section under GSTR-2A > Part-C (like the one shown below in Image #4), but with Accept/Reject options. If you sell on multiple eCommerce platforms, you must ideally see one entry for each marketplace along with their eCommerce Operator GSTIN (with the 14th letter as C). You could search for the eCommerce Operator GSTIN of each marketplace if you do not have it already in GST Portal under Search Taxpayer > Search by PAN.

#4: Details of TDS and TCS Credits received

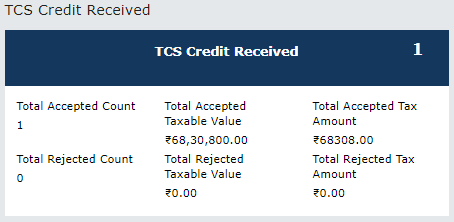

You can either Accept or Reject the filing by the marketplaces (These options were grayed out until now & it is not open for our action). Things are not clear on what happens when you reject the numbers filed by e-Commerce marketplaces (please expect an update on this later). If all data filed by marketplaces are fine and acceptable to us, you can select them & Click on Accept to mark your agreement. Once you Accept/Reject the filings, please generate the Summary from “TDS and TCS Credits Received” for filing and, the “TDS & TCS Credits Received” section will show 1 against the TCS Section as shown below in Image #5

#5: TCS Credits received after accepting one of the GSTR-8 filing entry for TCS.

Step 3: File “TDS and TCS Credits Received” Return using DSC or EVC Validation

Once you have Accepted/Rejected the entries from marketplaces, you can generate the Summary file for Filing & the option to “FILE TDS TCS CREDITS RECEIVED” button will get enabled. We will only see it in Electronic Cash Ledger only after we file the acceptance.

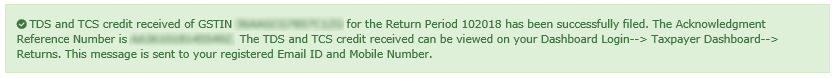

Once you’re sure that you are seeing entries from all marketplaces you sell on, you can Prepare the Summary & file the return like how you normally do for other GST returns. You can navigate to Return Dashboard > Select Month > Click on “Prepare Online” button under “TDS and TCS Credits received” section > Click on “Proceed to File” to generate Summary > Select Signatory & file the return via DSC or OTP. Once you file the return, you will see a message like the one shown in Image #6.

#6: TDS and TCS Credits received acceptance filing

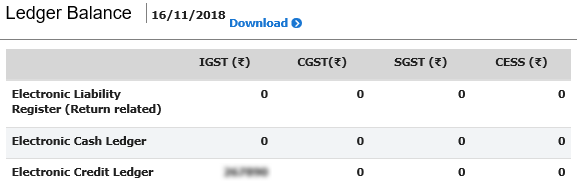

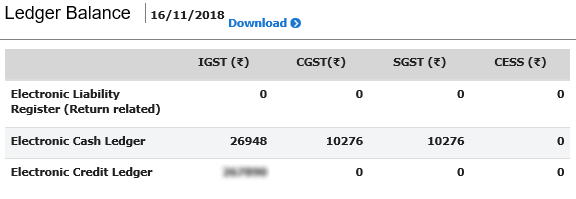

#7: Ledger Balance before Filing the Acceptance Filing

#8: Ledger Balance after Filing the Acceptance Filing

Image #7 & #8 above shows how the Ledger Balance looks like before & after the filing, the acceptance under “TDS and TCS Credits received” section. Now, the TCS Credit received would be available for us to offset the Output Tax Liability. The return dashboard will be like this once we file our acceptance (Image #9)

#9: Return dashboard after filing “TDS and TCS Credit Received” acceptance.

Step 4: Use the TCS Credits available in Electronic Cash Ledger to pay Output GST Liability in GSTR-3B

Until now, Electronic Cash Ledger will show a positive balance when we pay a Challan in excess to offset the GST Output liability. Now, TCS credits will also flow into the Same ledger while the Input Tax Credit (ITC) would flow directly into Electronic Credit Ledger.

As you are aware, accumulated ITC can be refundable only in a few specific scenarios and you can read the details here to know more about it. But, excess balance in Electronic Cash Ledger must be refundable since it is real cash deducted from our NET settlement.

Hence, we should make sure we exhaust ITC balance (Electronic Credit Ledger) before start utilizing the Electronic Cash Ledger balance for offsetting the Output GST Liability.

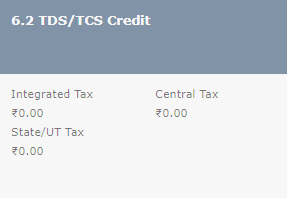

Like GSTR-1, GSTR-3B workflow is not yet ready to declare the TCS Credits received & hence you will see the Section 6.2 greyed out now (Image #10). We need to wait & watch the relevance of this Section once it is enabled. As of now, the TCS credits will flow into Electronic Cash Ledger anyways & nothing will stop you to claim it while filing the GSTR-3B return. I will update the process here once I could successfully file the GSTR-3B return by taking Credits from GSTR-8.

#10: Section 6.2 of GSTR-3B Return Filing Dashboard

Thanks a lot!

We really appreciate your patience in reading the article. Any constructive comments/feedback would really help us to improve our articles. Hence, please do not hesitate to post your valuable feedback/inputs in the Comments section below. Please Subscribe to our Newsletter & Share this article if you think it helps the larger e-Commerce Seller Community.

Please Fill this Form if you wish to avail our GST Data Consolidation & Filing Service for eCommerce (including Offline) services. We’re specialized in e-Commerce GST & we would love to serve you with our Managed Service Offerings for e-Commerce GST & other Accounting Services with the help of our in-house semi-automated system designed for e-Commerce. You could visit our GST Service Offering for more details.

Cheers! ✌✌

AS TCS is credited in electronic cash ledger its clear, but the amount is also showing in total input recived summry also. how it can be. either we take input or we take in cash ledger. please explain

Hello Ankur, Sorry for the delay in reply. As of now, I do not see a scenario where you need to Reject the TCS posted by marketplaces. If you think there is a mismatch, there must be something wrong with your calculation. I’ve validated this for Amazon, Flipkart & PayTm and all are accurate.

Any update on what happens if we reject it

If the invoice date is in Oct, nothing wrong in deducting TCS on it. If it is collected, it must have been filed by Marketplace too. There must be some error somewhere, else please get in touch with the respective marketplace if you think they’re posting wrong figures.

Sir

In our case TCS has been collected by e-commerce market place on a few orders which were generated on last 2 days of September 2018 but Invoice prepared on 01-10-2018. TCS on such orders has been collected from us but has not been reflecting in the GST Portal. In that case what should be done.?