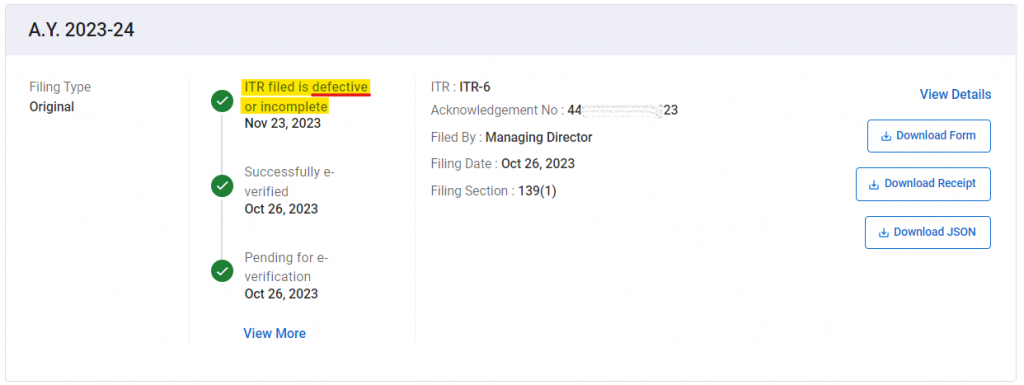

As many of you are aware, many E-Commerce sellers are receiving notices/defective returns stating that the Total Aggregate/NET turnover reported in the Income Tax Return is much lower than the Turnover reported by the Marketplaces when they deduct TDS under section 194O. TDS u/s 194-O was introduced in Oct 2020. Since it was only applicable for the 6 months, the Income Tax Returns for FY2020-21. Many have been receiving these notices for the last 2 financial years (from FY2021-22 returns onwards) if your primary Income is from E-Commerce Sales. Let’s analyze this in detail.

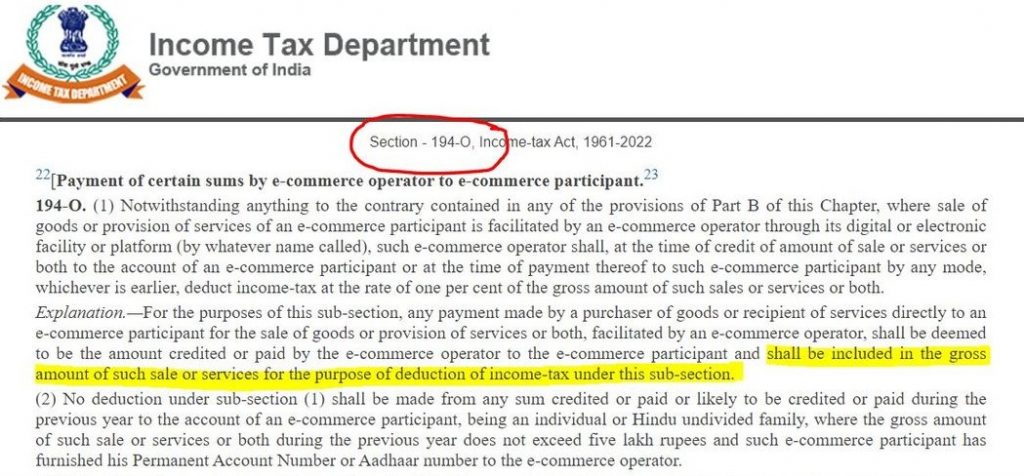

What is the TDS under section 194-O?

Marketplaces (a.k.a. ECommerce Operators) are liable to deduct TDS u/s 194-O for the Sales made through their E-Commerce marketplace websites. TDS u/s 194-O should be deducted at 1% on the GROSS Taxable Sales made through their platform/website. You may read more about this by visiting the reference link shared along with this post below.

Any payment made by a purchaser of goods or recipient of services directly to an e-commerce participant for the sale of goods or provision of services or both, facilitated by an e-commerce operator, shall be deemed to be the amount credited or paid by the e-commerce operator to the e-commerce participant and shall be included in the gross amount of such sale or services for the purpose of deduction of income-tax under this sub-section

What does that mean? Is TDS applicable only on Sales Transactions?

Yes, TDS u/s 194-O will be deducted only on the Gross Sales and not on the NET sales after adjusting the returns. So, if you have made 1,00,000 + GST Sales on Amazon and about 25,000 + GST worth of product came back as customer/courier return, the TDS u/s 194 will be calculated at 1% on 1,00,000 and the total TDS deduction will be Rs. 1,000. But your NET turnover will only be 75,000 and the same will be reported in the Income Tax Returns, which is correct.

If you analyze Amazon’s Payment Reports for example (Date Range report or Payment Flat file V2), you can see that the TDS is deducted only on the Sales transactions and it is not reversed when the order is returned/canceled. You can also find that Amazon calculates the Gross turnover for a particular day and deducts 1% on the Gross sales every day and you will only see 1 deduction entry per day for TDS deductions.

But, the TCS under GST is also @1% and it is matching with our monthly GST Turnover. Why?

TCS under the GST Act is calculated on the NET Sales (NET of aggregate sales after deducting Returns/Refunds/Cancellations) and it is also to be deducted @1%. But, the TCS deduction (in the case above) will be Rs. 750/- since it is applicable on NET Sales (Rs. 1,00,000 – 25,000 = 75,000). And TDS u/s 194-O of Income Tax will be deducted at 1% on Gross Sales (Rs. 1,00,000) and Rs. 1,000/- will be deducted and paid to Govt against your company/business PAN.

So, TDS & TCS deductions will be different though they are deducted @1%?

Yes. Both TCS under GST and TDS under Income Tax are deducted at 1% on the Sales. But, the point of deduction and the turnover on which it is applicable are different. TCS under GST is deducted @1% on NET Sales while TDS under 194-O is deducted @1% on Gross Sales.

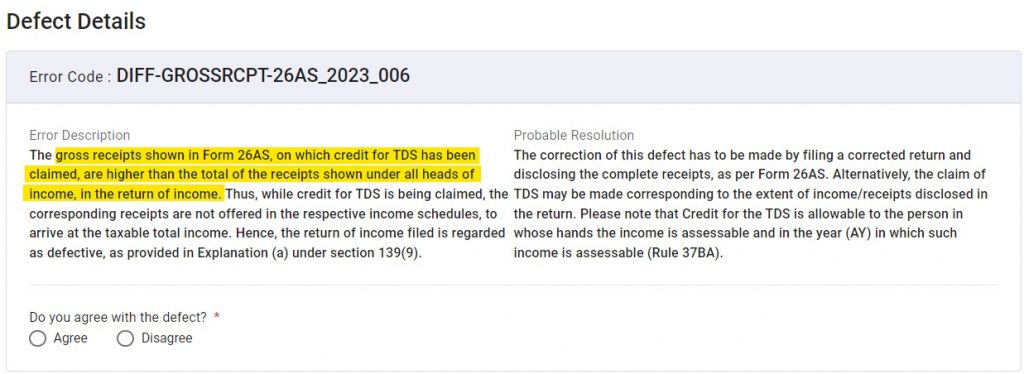

Does this mean that the notice we received is wrong?

Unfortunately, yes. The automated defective return notice does not consider that the TDS u/s 194-O will be on the gross turnover. The Income Tax automated system assumes that the TDS deduction is always on your NET Income and also assumes that your reported Income as per the Income Tax return filed should be more than the turnover reported in TDS.

How to reply to the Defective Return notices?

You should frame a reply stating that the TDS u/s 194-O is on the Gross Sales and it does not consider the E-Commerce marketplace return which is often in the range of 30% of the gross sales. Hence, the actual Income (net of Sales and returns) from the E-Commerce marketplaces will be about 70% of the Gross Turnover reported in the TDS u/s 194-O. You may also reply stating that the E-Commerce Marketplace Turnover reported in GST under TCS provisions matches with the turnover reported in your Income Tax Filing. You may include the Turnover Figures of each marketplace under TDS & TCS to justify this.

References:

- https://incometaxindia.gov.in/news/circular-20-2021.pdf

- https://cleartax.in/s/section-194o

- https://taxguru.in/income-tax/section-194o-tds-e-commerce-operator-analysis.html

Hope this helps to clear all your queries and concerns about the defective notices received. Please Subscribe to our Newsletter & share this article if you think it helps the larger e-commerce Seller Community.

We’re specialists in E-Commerce Compliance! We’re equipped to E-Commerce business of any scale.

We have been specializing in E-Commerce GST and TDS compliances since the inception of GST. We’ve built-in IT infrastructures & automation and we’ve tailor-made processes in place to handle GST and other compliances. In a nutshell, we’re well-equipped to handle all of these compliance headaches on your behalf.

- We provide services for over 185+ E-Commerce entities from 16 states

- 100% of our clients are selling on e-Commerce

- We’ve filed more than 18,000+ e-Commerce GST returns (as of Oct 2023)

- We’re fully integrated with the GST & E-Invoice portals

- We do all possible validations & reconciliations (like TCS vs Marketplace Turnover Reconciliation, E-Invoice Reconciliation, GSTR-2B & 2A reconciliation for ITC, etc.) and we do it every month without fail.

- You can read more about us here

Please reach out to us at compliance@fidesloop.com or on 959 144 3993 (WhatsApp) if you wish to sign up for our Managed Service offering for e-Commerce GST compliance and other add-on services like TDS, e-Commerce Accounting, etc. Alternatively, you click on the Get Quote button in the top-right corner of the website and fill in the details and we will revert you for further discussions.